Pillar One Summary »

Qualified Domestic Minimum Tax (QDMT) Explained FieConsult

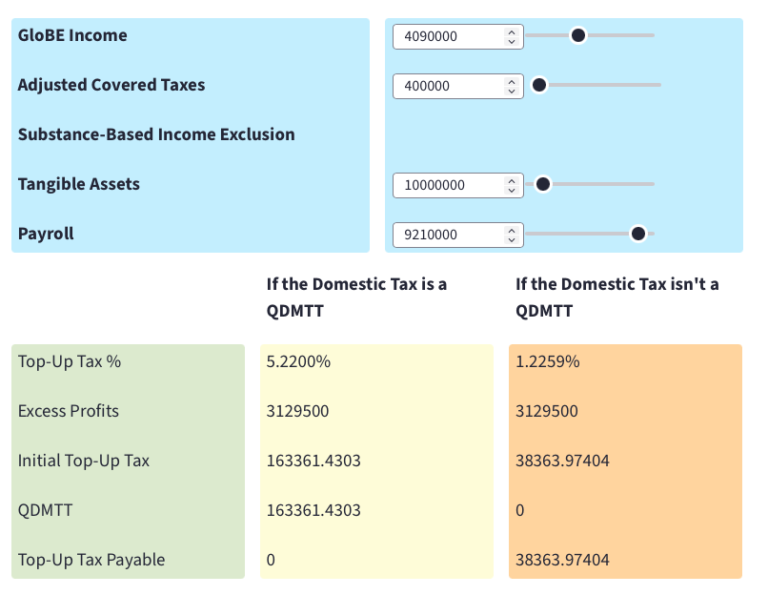

The total tax is 140,000 euros. If the Domestic Top-Up Tax is a QDMTT. In this case covered tax is 100,000 euros. The top-up tax calculation is: 5% * 800,000 = 40,000 - 40,000 (QDMTT) = 0. Treating the domestic top-up tax as a QDMTT eliminates any top-up tax under the GloBE rules. If the Domestic Top-Up Tax isn't a QDMTT.

2022 tax brackets Lashell Ahern

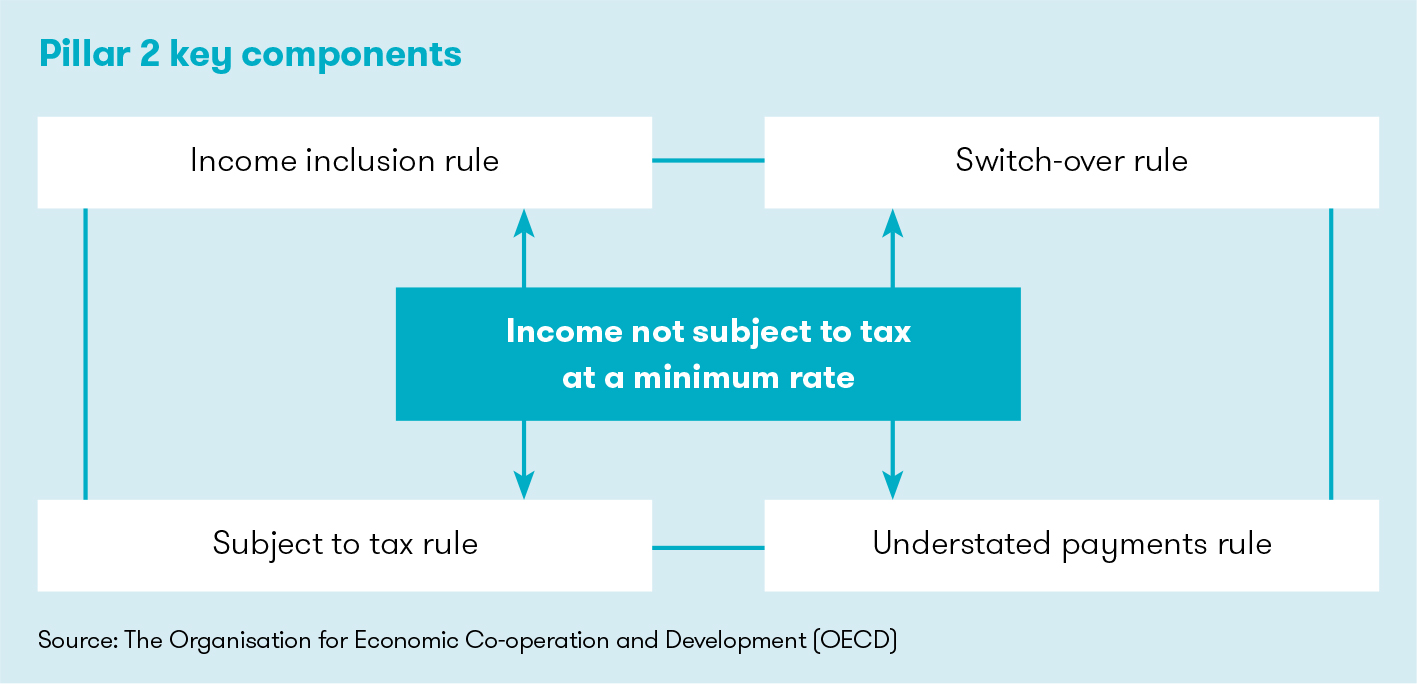

a qualified domestic minimum top-up tax (QDMTT). Large groups will be required to pay a top-up tax where their UK operations have an effective tax rate of less than 15%. The government also intends to implement the (backstop) undertaxed profits rule (UTPR) in the UK.

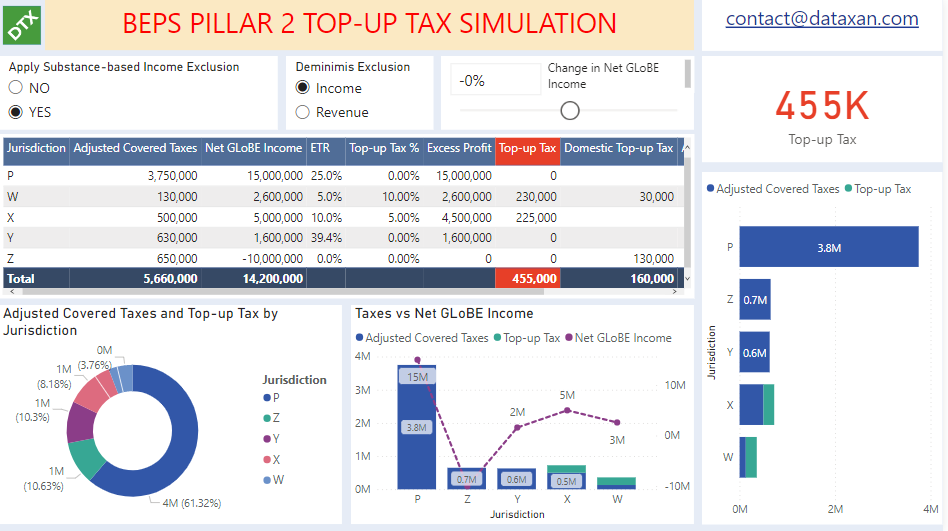

GLOBAL MINIMUM TAX BEPS PILLAR 2 TOP UP TAX SIMULATION DaTaxan

percentage mark-up on tangible assets and payroll costs. Finally, if a jurisdiction has a domestic minimum tax that is consistent with the Pillar Two Model Rules ("Qualified Domestic Minimum Top-up Tax", or "QDMTT"), such domestic tax eliminates any top -up tax liability under the GloBE rules when it is treated as a QDMTT Safe Harbour.

Sweetening the deal? Opinion News The Financial Express

The third mechanism is the Qualified Domestic Minimum Top-up Tax (QDMTT). The QMDDT is a minimum top-up tax applied to domestic companies in the source country where they operate. Let's say a subsidiary in Ireland has an ETR of 10 percent and income of $1 million. If Ireland has a QDMTT, it will apply a top-up tax of $50,000 so that the.

Global Minimum Tax

Also included is guidance on domestic minimum taxes, known as Qualified Domestic Minimum Top-up Taxes (QDMTTs), that countries may choose to adopt.. A consensus statement by all Inclusive Framework members that Pillar Two was intentionally designed so that top-up tax imposed in accordance with those rules will be compatible with common tax.

Pillar 1 & 2 Rules the Key Components Oversimplified Part 2 FutureMoves Group

Qualified domestic minimum top-up tax. The Administrative Gidance also provides details regarding the design of qualified domestic top-up taxes (QDMTT). The QDMTT concept was introduced in December, 2021 and allows jurisdictions to introduce a domestic top-up tax that is aligned with Pillar Two and applies to domestic entities that are within.

Is a global minimum tax to be introduced? Grant Thornton

amount of tax on the MNE Group's excess profits in that low-tax jurisdiction up to the 15% rate. 3. This top-up tax is either collected by the low-tax jurisdiction itself, under a so called Qualified Domestic Minimum Top-up Tax (QDMTT), or, where no QDMTT applies, by another implementing jurisdiction through the imposition of either: a.

Exploring Options Drafting Domestic Minimum TopUp Tax Legislation in Africa

Qualified domestic minimum top-up taxes (QDMTTs) allow jurisdictions to introduce a minimum corporate rate and maintain a competitive tax regime. A growing list of jurisdictions are drafting legislation for QDMTTs that are derived from the OECD's model rules on pillar two. Hong Kong SAR has announced it will be opting for a QDMTT regime.

Tax hacks Pay less tax with CPF & SRS topups YouTube

Top-up Tax accrued under a Qualified IIR or a Qualified Domestic Minimum Top-up Tax is excluded from Covered Taxes. Also excluded are taxes attributable to an adjustment as a result of a Qualified UTPR, a disqualified Refundable Imputation Tax, and taxes paid by an insurance company with respect to returns of policyholders.

Ireland Consultation on Global minimum tax TPA Global

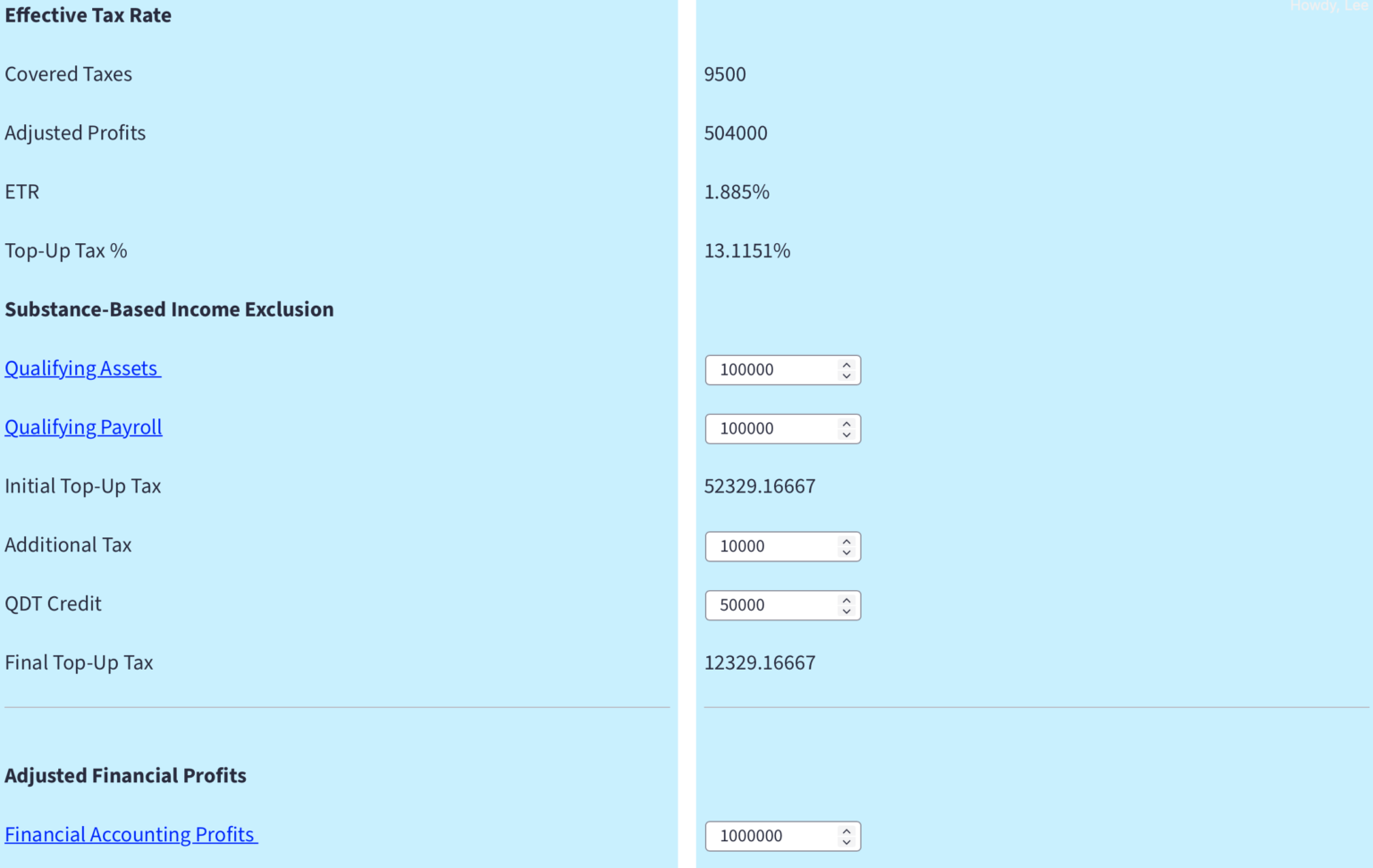

Pillar Two: QDMTT - Interactive Tool. Overview Our Qualified Domestic Minimum Top-Up Tax (QDMTT) interactive tool allows you simulate the impact on your top-up tax liability depending on whether the domestic top-up tax is a QDMTT or is non-qualifying. Of key importance is that a domestic top-up tax that doesn't qualify as a QDMTT would simply.

Pillar Two Domestic Minimum Tax Interactive Tool

A key development is the option to enact a Qualified Domestic Minimum Top-up Tax creditable against the GloBE rules in parent jurisdictions. This will be relevant for developing countries that otherwise would have little direct revenue to gain from the implementation of the global minimum tax. They could benefit indirectly from a reduction in.

Pillar One Summary »

Global minimum top-up tax. Read our publication. Update (29 September 2023): The IASB has also published amendments to Section 29 Income Tax of the IFRS for SMEs Accounting Standard. They are similar to those made to IAS 12 under the full IFRS Accounting Standards, although the approach to disclosures about exposure to the top-up tax differs.

Types of Taxes The 3 Basic Tax Types Tax Foundation

To be a Qualified Domestic Minimum Top- up Tax, the regime must exclude tax paid or accrued by domestic constituent entities (CEs) with respect to the income of foreign CEs under its own CFC regime. A jurisdiction under a QDMTT regime can go even further and exclude all taxes that it imposes on a forei gn CFC or hybrid entity.

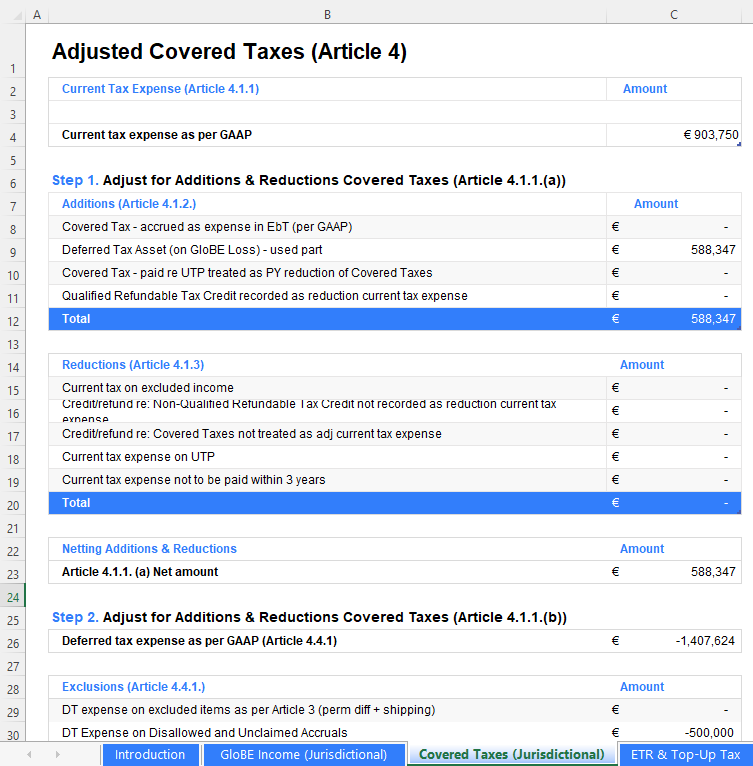

Pillar Two TopUp Tax Sample Calculation for one single constituent entity

A draft bill implementing the EU Minimum Tax Directive (Council Directive (EU) 2022/2523 of 14 December 2022) in Poland has been published on the government legislation center's website. The draft bill provides for an income inclusion rule (IIR), a qualified domestic minimum top-up tax (QDMTT), and an undertaxed profit rule (UTPR). The bill.

THE GLOBAL MINIMUM TAX (GMT)

A QDMTT is a minimum tax that is incorporated into the domestic law of a jurisdiction. It must compute profits and calculate any top-up tax due in the same way as the Pillar Two rules themselves. To ensure a level playing field, a QDMTT must be implemented and administered in a way that is consistent with the Model Rules with no collateral or.

UK Multinational TopUp Tax Calculator »

The guidance indicates that a jurisdiction's qualified domestic minimum top-up tax would generally apply before the blended CFC allocation rules. Because taxes attributable to the GILTI and Subpart F inclusions are not considered covered taxes, the OECD believes that top-up taxes are likely to be creditable. However, this point has not been.